One Bitcoin Club

Affordable crypto estate planning services for owners of at least 1 BTC

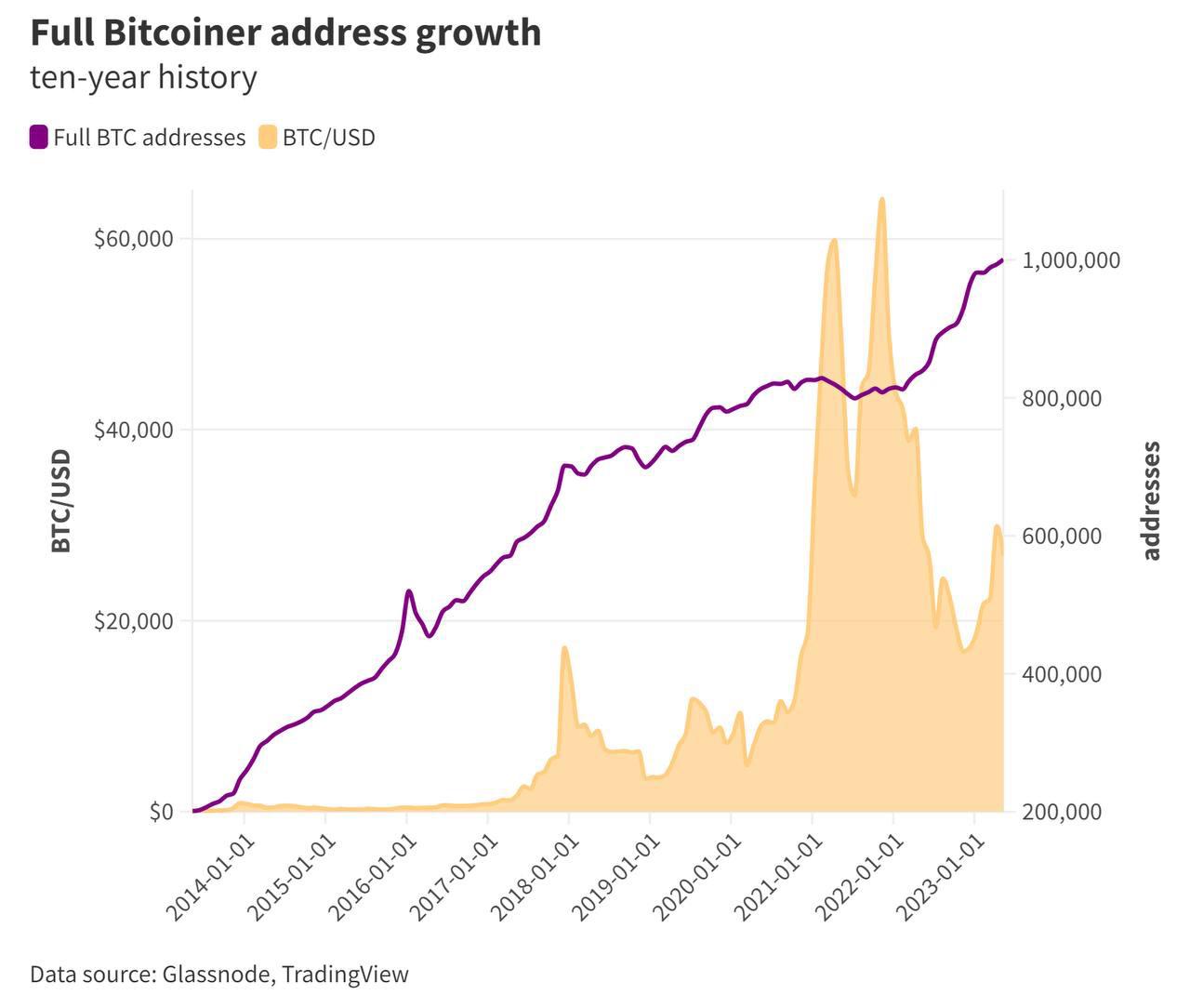

Holding 1+ full BTC puts you in the top 2% of all Bitcoiners accounting for 92% of the total supply. On paper, you may not be a millionaire (yet), but it's time to start thinking like one.

We know what it's like to be in your position and had to figure things out along the way. No one would talk to us because we are NOT a Family Office, Fund, or Corporate Entity and refused to trust our BTC with a 3rd party.

Ensure your Bitcoin is protected for future generations

Never give up control of your private keys to a 3rd Party.

Not your keys, not your coins.

Your Future Self Will Thank You

Bitcoin represents a sovereign right to own a fixed percentage of the world’s money indefinitely. The responsibility of protecting your Bitcoin and preserving your future generational wealth starts today. Even if you’re not technically wealthy (yet) by TradFi’s standards, waiting until the price of BTC goes parabolic is too late and the stakes are too high!

Stratus vs. Other Services

| Stratus Bitcoin Whole-Coiner Service | Other Private Services |

|---|---|

| Ideal for: Bitcoin 'Whole-Coiners' who want complete control of their crypto assets with wealth transfer protocols and optional emergency seed recovery. | Ideal for: The elite "sophisticated investor buying more than $100,000 of Bitcoin" indulging in "Private Parties" & "VIP Dinners". |

| Trust Level: We don't expect you to trust any person, company or claim in crypto. "Self-custody eliminates placing trust in others." | Trust Level: OMG! "utilizing qualified custodians and operating in jurisdictions with strong property rights have thus far not betrayed the trust put in them." |

| Requirements: Holder of 1+ BTC | Requirements: $1M+ Net Worth, IRA Trust, LLC, Funds or Family Offices |

| Fees: 0.2% + Legal Fees | Fees: 0.99%-1.2% + Legal Fees * (example: IRA $600 up front, $30/mo) |

| Risks: We don't act as a custodian of your coins so there's no money transfer risk and we'll never ask for your private keys. | Risk: 'Fraud, cyber attack, or theft', "custody, bankruptcy, and regulatory risk". |

| Bitcoin Storage: Self Custody or Exchange Custody. Keys are never on our platform. | Bitcoin Storage: 3rd Party Custody "with the assistance of a trusted third party" meaning your keys are managed by others. |

| Services: Legal Estate Planning, Proprietary Offline and Distributed In-person Cold Storage Recovery Process. Your keys are never stored or transmitted digitally. | Services: IRA, Wealth Transfer, Custodian of your keys, and other traditional financial services designed for wealthy few. |

Generational Wealth Protection for Whole Coiners

Our team of crypto experts and estate lawyers across the country will provide you with a strong legal foundation to protect your future wealth and estate planning.

We will help you manage the unknown unknowns that no one in crypto wants to talk about like:

- What would happen to my Bitcoin if I died unexpectedly tomorrow!

- How will my family access and recover all of my crypto wallets?

- What happens if I lose my backup seed and can't recover my cold wallet?

- How can I protect my BTC from government seizure or unauthorized access?